36+ Minimum payment on 50000 credit card

There are many reasons why it is dangerous only to make a minimum amount credit card payment but the biggest reason is the amount of money you will spend over time. The interest-free period is generally 6-21 months after which the credit card will require payment of interest on top of the principal.

Used Toyota Camry Hybrid For Sale Near Me Cars Com

Save money with interest rates significantly lower than most.

. A better answer than to make the smaller minimum payments as they continue to drop is to keep paying 1500 a month. You have a credit card with an APR of 36. This is your initial monthly payment.

Learn more about CareCredit healthcare credit card payments with the Payment Calculator from CareCredit. The below example is for. By the end of this first payment your owed.

The minimum payment on a 2000 credit card balance is at least 20 plus any fees interest and past-due amounts if applicable. This would get the 50000 paid off in. While there are no credit cards with a 50000 minimum credit limit there are some options with minimum limits of 5000 or 10000 that many people claim to have gotten.

Credit Card payments are typically setup to deduct the minimum monthly repayment this will normally be calculated as a percentage of the outstanding balance. The monthly payment on a 50000 loan ranges from 683 to 5023 depending on the APR and how long the loan lasts. 425 30 votes.

Some credit. Your monthly payment is calculated as the percent of your current outstanding. If your credit card balance is.

Your minimum payment is calculated as a small percentage of your total credit card balance or at fixed dollar value whichever is greater. A Secured Card With No Annual Fee. Credit cards with a flat percentage minimum payment usually require 2 to 4 of your balance each month.

For customers who have a CareCredit card simply enter the amount youd like to. To see how dramatic a difference that makes look at the difference in monthly payments and interest charged on a 50000 credit card debt paying the national average of. Compare rates by card type.

For credit cards this is calculated as your minimum payment. Your minimum required payment is typically anywhere from 2 to 4 of your total balance for that billing cycle depending on your particular card agreement. Take advantage of low interest rates and fixed monthly payments making personal loans ideal for credit card debt consolidation.

A better solution. The minimum payment must be paid by the cutoff time on the payment due date. For most credit cards the cutoff time for your minimum payment is 5 pm.

Taking that into account if your total balance for a credit. Credit card minimum payments are usually calculated based on your monthly balance. Some cards can charge a fee of 3 or 4 of the total amount.

For example if you take out a 50000 loan for one.

2

Westernunion Usd To Inr Best International Money Transfer Website Send Money Money Transfer Money

The 7 Online Banks Like Chime Chime Bank Alternatives

Best Forex Brokers In Germany With Bafin Regulation For 2022

Free 54 Request Letter Templates In Ms Word Google Docs Pages Pdf

Apple Iphone 13 Pro Apple Iphone Iphone Apple

2

2

The 7 Online Banks Like Chime Chime Bank Alternatives

Faux Credit Or Debit Card Look Metallic Zazzle Custom Business Cards Construction Business Cards Modern Business Cards

2

Does Digital Marketing Have A Good Career In India What Is The Average Salary Path In This Field Quora

2

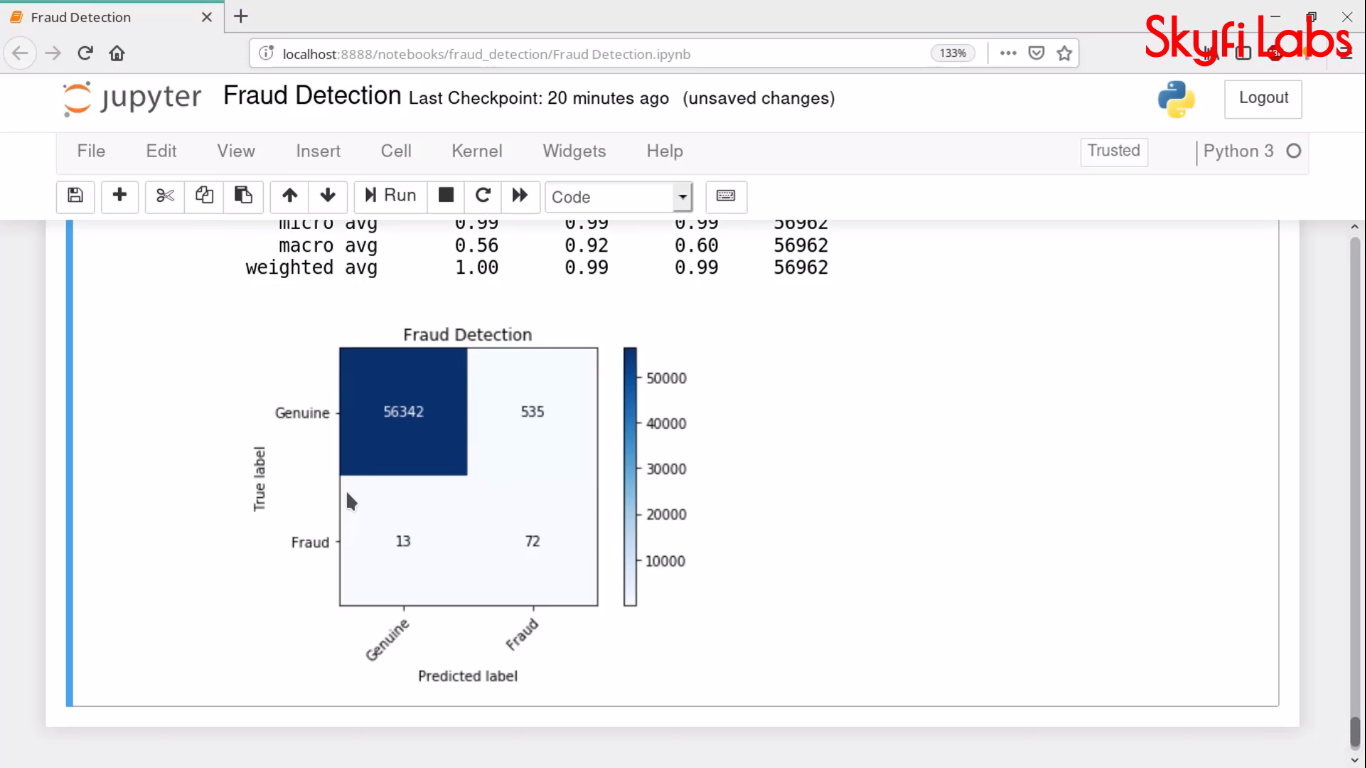

Top 77 Projects Based On Machine Learning

U S Bank To Offer Bonus Points For Winter Olympics Wins Bestcards

Afk Endgame Theory Mechanics V1 02 Based On 1 59 Updated For 1 63 R Afkarena

Page 3 The Points Guy Uk